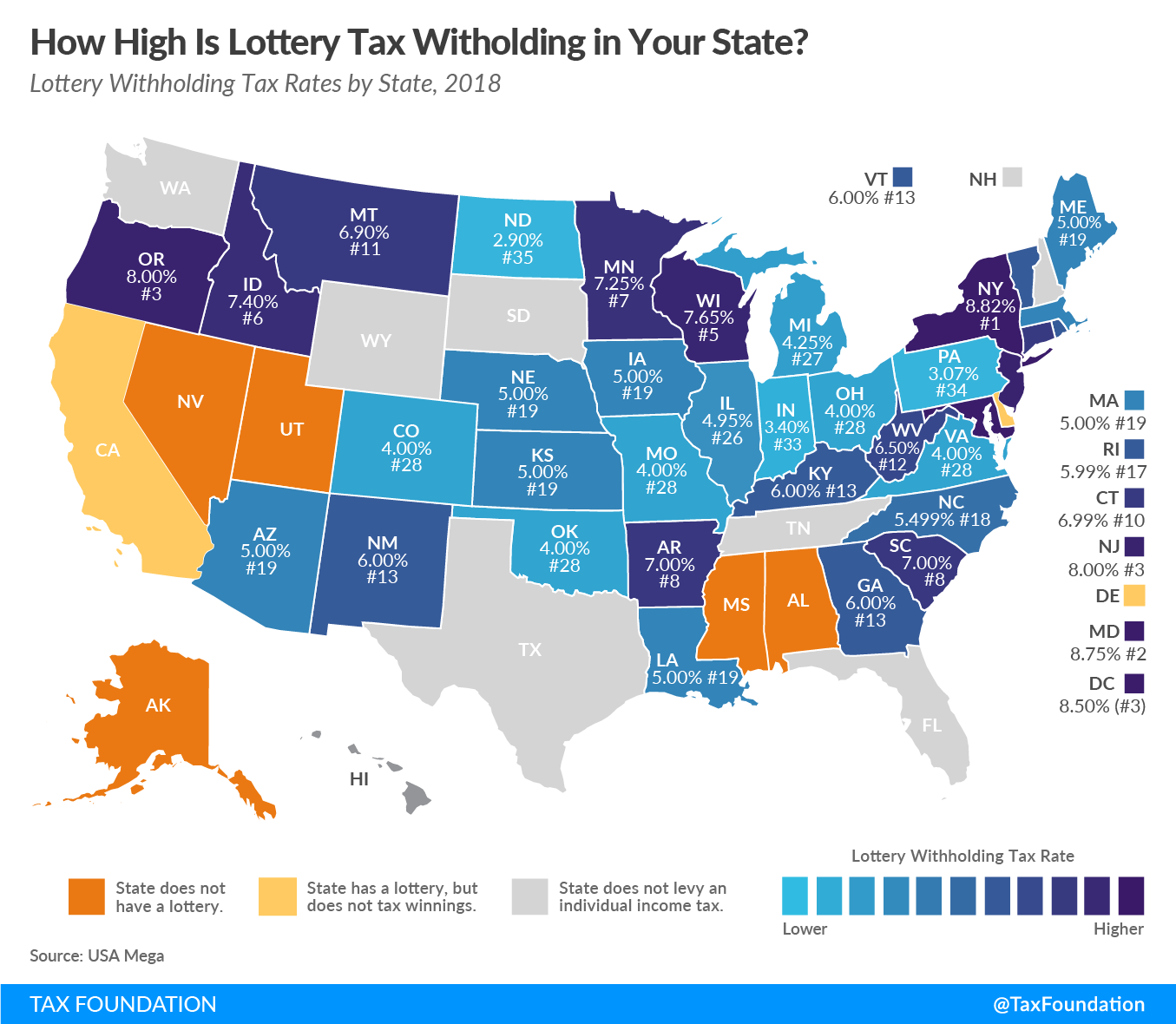

The New York Department of Finance and Taxation, for instance, allows you to itemize expenses on Form IT-201, as long as they don’t exceed the amount of winnings you reported under other income. Before you claim any gambling expenses, make sure you have approved documentation to back it up. How Are Lottery Winnings Taxed by State? Come tax time, some states will also take a piece of your lottery winnings. How large a piece depends on where you live. The Big Apple takes the biggest bite, at up to 13%. That’s because New York State’s income tax can be as high as 8.82%, and New York City levies one up to 3.876%.

State lotteries provide revenue for government coffers in more than one way. Apart from ticket sales, lotteries also produce new income for winners, income that's subject to federal and state taxes. The Internal Revenue Service requires states to withhold federal taxes from some prizes. Depending on where you live or where you win, the state may also withhold state taxes. The amount of tax you'll pay overall on Lotto winnings depends on the prize, the state and your other income.Federal Income Taxes

State lotteries must issue a federal W-2G form for winnings of $600 or more as of early 2011. If you're a U.S. resident, but don't have a Social Security number, the state withholds 28 percent from winnings of $600 or more to pay federal income taxes. Each state must withhold 25 percent from prizes greater than $5,000 won by U.S. citizens and resident aliens with Social Security numbers. They withhold 30 percent from all prizes won by citizens of other countries who aren't U.S. residents.State and Local Income Taxes

State income tax rates and rules vary from state to state, so the amount you'll pay in state taxes depends on where you live and the state that issues the prize. Florida and Texas, for example, have no state personal income taxes as of 2011, so residents of those states who win a Florida or Texas Lotto prize don't pay state income tax on their winnings. New York does have a state income tax. If you win the New York State Lotto, New York will withhold New York taxes on prizes of more than $5,000, regardless of where you live. The state income tax rate is 8.82%. New York City withholding 3.876%. Yonkers withholding 1.323%.FAQs: New York State Lottery Winners Tax Responsibilities

This publication provides guidance on the New York State, New York City, and Yonkers personal income tax treatment of lottery prizes. This guidance applies specifically to prizes from lottery games conducted by the New York State Division of Lottery (New York State Lottery). New York State lottery prizes include prizes from all games conducted by the New York State Lottery, including the multi-state Mega Millions game (if the winning ticket was purchased in New York State) and video lottery games at a video-gaming facility that has been licensed by the New York State Lottery. (See the New York State Lottery Web site (www.nylottery.org) for more information on lottery games.)

In many instances, the New York State, New York City, and Yonkers tax treatment of prize payments depends upon the amount of the proceeds from the prize. For this purpose, proceeds means the total amount of the prize won (not each installment amount, if the prize is payable in installments), less the cost to purchase the winning ticket. If the prize is won by a group, proceeds means the total prize won by the group (not each group member.s share of the prize) less the cost of the winning ticket.

1)Q: I am a resident of New York State and I won a prize in the New York State Lottery. Is the prize payment I received subject to New York State income tax?A:Yes. If you are a resident of New York State, your prize payment is subject to New York State income tax if the prize payment is includable in your federal adjusted gross income for the tax year. If you are a resident of New York City or Yonkers, the prize payment will also be subject to the applicable city resident income taxes.

2)Q: I am a nonresident of New York State. I won a prize in the New York State Lottery. Is the prize payment I received and any future installment payments (if the prize is payable in installments) subject to New York State income tax?

A:If you won the prize on or after October 1, 2000, and the proceeds exceed $5,000, your lottery prize payment is New York source income and is subject to New York State income tax.

If the proceeds are $5,000 or less, or the prize was won before October 1, 2000, the prize payment(s) is not considered New York source income and is not subject to New York income tax.3)Q: Is my New York State lottery prize payment subject to New York State, New York City, or Yonkers withholding taxes?

A:All prizes won on or after October 1, 2000, are subject to New York State withholding tax if the proceeds exceed $5,000. Prizes won prior to October 1, 2000, are subject to New York State withholding if the proceeds exceed $5,000 and you were a New York State resident at the time you won the prize. These prize payments are also subject to New York City and Yonkers withholding if you were a resident of New York City or Yonkers at the time you won the prize.

If withholding is required, the New York State Lottery is required by law to withhold tax using the highest effective rate of state tax for the year in which a payment is made, without any allowance for deductions or exemptions. If you are a resident of New York City or Yonkers, the prize payment(s) is also subject to city withholding at the city.s highest effective rate of tax.To ensure that you will not be subject to a penalty for failure to pay estimated tax, you should estimate your total income tax liability for the year to determine if you should be paying estimated tax, even though your lottery prize is subject to New York State, New York City, or Yonkers withholding tax. For more information on estimated tax, see the instructions for Form IT-2105, Estimated Income Tax Payment Voucher for Individuals; Form IT-2106, Estimated Income Tax Payment Voucher for Fiduciaries; or Publication 94, Should You Be Paying Estimated Tax?4)Q: If I move into New York State during the year, how does my change from a nonresident to a resident affect my state income tax obligation with respect to a New York State lottery prize payment(s) that I am entitled to receive after the move?

A:When you change your status from a nonresident of New York State to a resident of New York State and are entitled to receive a New York State lottery prize payment(s) from a lottery prize won while you were a nonresident, the tax treatment depends on the amount of the proceeds and when you won your prize.

If the proceeds are $5,000 or less, the prize payment is not considered New York source income and it is not subject to New York State income tax.

If the proceeds exceed $5,000, and the prize was won on or after October 1, 2000, the prize payment(s) is considered New York source income and is subject to New York State income tax.

If you won the prize before October 1, 2000, and you are receiving installment payments, special accrual rules apply. Under these accrual rules, in the year of the change you must include, in your New York adjusted gross income in the Federal amount column of Form IT-203, Nonresident and Part-Year Resident Income Tax Return, the total amount of the installment payments you are entitled to receive in the future. However, do not include that amount in your New York source income (the New York State amount column of Form IT-203). In addition, the installment payment(s) received in the following tax year(s) must be subtracted from federal adjusted gross income in computing New York adjusted gross income, and therefore is not subject to New York State income tax. (The subtraction is limited to the amount of the installment payment included in federal adjusted gross income.)

5)Q: I won a prize in a New York State Lottery drawing that was held while I was a resident of New York State. I moved out of New York State before I claimed my prize. Later that same year, I came back to New York State just to claim my prize payment. How does my change from a resident to a nonresident affect my New York State income tax obligation with respect to the lottery prize payment that I received as a nonresident? Do I still have to pay New York State taxes?

A:When you change your status from a resident of New York State to a nonresident of New York State and are entitled to receive a prize payment from a lottery prize won while you were a resident, you must pay New York State income tax on the payment(s) you are entitled to receive, even if the prize payment is received during the nonresident period of your tax year. As a part-year New York State resident, you must file Form IT-203, Nonresident and Part-Year Resident Income Tax Return, and include in New York source income the amount of the prize payment received.

6)Q: I won a prize in the New York State Lottery while I was a resident of New York State. I then moved out of New York State and will not return to claim my prize until the following year when I am a nonresident. How will the change from a resident to a nonresident affect my New York State income tax obligation with respect to the lottery prize payment (or installment payments) that I will claim and receive in a future tax year(s) as a nonresident? Do I still have to pay New York State taxes?

Does New York State Tax Gambling Winnings

A:When you change your status from a resident of New York State to a nonresident of New York State and are entitled to receive a payment or installment payments from a lottery prize won while you were a resident, you must pay New York State income tax on the prize payment(s) you are entitled to receive in a future tax year(s). However, when the tax must be paid depends upon whether or not the prize payment is subject to New York State withholding tax.

If the proceeds from the prize are less than $5,000, the prize payment is not subject to New York State withholding tax. Instead, the prize is subject to special accrual rules. Under these special accrual rules:

The total amount of the unpaid prize that is not included in your federal adjusted gross income for the year of change on your federal income tax return must be included in New York adjusted gross income (Federal amount column of Form IT-203) and New York source income (New York State amount column of Form IT-203) for the year of change of residence on your New York State income tax return, unless you file a bond or other acceptable security with the Tax Department.

If you file a bond or other acceptable security with the Tax Department, the payment (or installment payments) is taxed in the year that the payment is actually received. As a result, you must file a New York State nonresident return (Form IT-203), and include in New York source income the amount of the payment received in that year. In the case of a prize that is payable in installments, you must file Form IT-203 for each future tax year that you receive an installment payment.

For more information on special accruals and change of resident status, see the instructions for Form IT-203, Form IT-260, New York State and City of New York Surety Bond Form . Change of Resident Status . Special Accruals, and Form IT-260.1, Change of Resident Status . Special Accruals.A lottery prize that is subject to New York State withholding tax (whether it is one payment or multiple installment payments) is included in New York source income and is subject to New York State income tax in the year the payment is received. As a result, you must file a New York State nonresident return (Form IT-203), and include in New York source income the amount of the payment received in that year. In the case of a prize that is payable in installments, you must file Form IT-203 for each future year that you receive an installment payment.

7)Q: If I move into New York City during the year, how does my change from a New York City nonresident to a New York City resident affect my city resident income tax obligation with respect to a New York State lottery prize payment(s) that I am entitled to receive after the move?

A:When you change your status from a nonresident of New York City to a resident of New York City and are entitled to receive a New York State lottery payment(s) from a lottery prize won while you were a nonresident of the city, the tax treatment depends on the amount of the proceeds and when you won your prize.

If the proceeds are $5,000 or less or you won the lottery prize before October 1, 2000 (regardless of the amount), special accrual rules apply. Under these accrual rules, any future payment(s) is not included in determining New York City taxable income for the year of change and any future year.

If the proceeds exceed $5,000 and you won the lottery prize on or after October 1, 2000, any payment(s) you receive during the city resident period in the year you changed residence must be included in New York City taxable income for the year of change. In addition, the payments (if the prize is payable in installments) received in future years will also be subject to New York City resident income tax.

Note: The New York City change of resident status income tax rules apply whether or not you changed your New York State resident status.

8)Q: I won a prize in a New York State Lottery drawing that was held while I was a resident of New York City. I moved out of the city and did not claim my prize until later that same year when I was a nonresident of New York City. How does my change from a New York City resident to a New York City nonresident affect my city resident income tax obligation with respect to a New York State lottery prize payment(s) that I received as a nonresident of the city? Do I still have to pay New York City income tax?

A:When you change your status from a resident of New York City to a nonresident of New York City and are entitled to receive a prize payment from a lottery prize you won while you were a New York City resident, you must pay New York City income taxes on the prize payment(s) you are entitled to receive, even if the prize payment is received after you became a nonresident of New York City. As a part-year New York City resident, you must include the amount of the prize payment(s) received in New York City taxable income.

Note: The New York City change of resident status income tax rules apply whether or not you changed your New York State resident status.

9)Q: I won a prize in the New York State Lottery while I was a resident of New York City. I then moved out of New York City and will not actually claim my prize until the following year when I am a nonresident of New York City. How will the change from a resident to a nonresident affect my New York City income tax obligation with respect to the lottery prize payment (or installment payments) that I will claim and receive in a future tax year(s) as a nonresident of the city? Do I still have to pay New York City taxes?

A:When you change your status from a resident of New York City to a nonresident of New York City and are entitled to receive a payment or installment payments from a lottery prize won while you were a resident, you must pay New York City income tax on the prize payment(s) you are entitled to receive in a future tax year(s). However, when the tax must be paid depends upon whether or not the prize payment is subject to New York City withholding tax.

If the proceeds from the prize are less than $5,000, the prize payment is not subject to New York City withholding tax. Instead, the prize is subject to special accrual rules. Under these special accrual rules:

The total amount of the unpaid prize that is not included in your federal adjusted gross income for the year of change on your federal income tax return must be included in New York City taxable income for the year of change of residence, unless you file a bond or other acceptable security with the Tax Department.

If you file a bond or other acceptable security with the Tax Department, the payment (or installment payments) is taxed in the year that the payment is actually received. As a result, you must compute the New York City tax using the New York City resident tax rates and include in New York City taxable income the amount of the payment received in that year. In the case of a prize that is payable in installments, you must compute the New York City tax for each future tax year that you receive an installment payment(s).

For more information on special accruals and change of resident status, see the instructions for Form IT-203, Form IT-260, New York State and City of New York Surety Bond Form 'Change of Resident Status' Special Accruals, and Form IT-260.1, Change of Resident Status . Special Accruals.A lottery prize that is subject to New York City withholding tax (whether it is one payment or multiple installment payments) is included in New York City taxable income and is subject to New York City income tax in the year the payment is received. As a result, you must compute the New York City tax using the New York City resident tax rates and include in New York City taxable income the amount of the payment received in that year. In the case of a prize that is payable in installments, you must compute the New York City tax for each future year that you receive an installment payment(s).

Note: The New York City change of resident status income tax rules apply whether or not you changed your New York State resident status.

10)Q: If I move into Yonkers during the year, how does my change from a Yonkers nonresident to a Yonkers resident affect my city income tax obligation with respect to a New York State lottery prize payment(s) that I am entitled to receive after the move?

A:When you change your status from a nonresident of Yonkers to a resident of Yonkers and are entitled to receive a New York State lottery payment(s) from a lottery prize won while you were a Yonkers nonresident, special accrual rules apply. Under these accrual rules, the total amount of the payment(s) you are entitled to receive in the future is includable in the portion of the year prior to the time you changed your residence. Any payment(s) accrued for this purpose must be excluded in determining your Yonkers resident income tax surcharge for the year of change and any future year.

Note: The Yonkers change of resident status income tax rules apply whether or not you changed your New York State resident status.

11)Q: I won a prize in a New York State Lottery drawing that was held while I was a resident of Yonkers. I moved out of Yonkers and did not claim my prize until later that same year when I was a nonresident of Yonkers. How does my change from a Yonkers resident to a Yonkers nonresident affect my Yonkers income tax obligation with respect to a New York State lottery prize payment(s) that I received as a nonresident of Yonkers? Do I still have to pay Yonkers income tax?

A:When you change your status from a Yonkers resident to a Yonkers nonresident and are entitled to receive a prize payment from a lottery prize won while you were a Yonkers resident, you must pay Yonkers income tax on the prize payment(s) you are entitled to receive, even if the prize payment is received after you became a nonresident. As a part-year Yonkers resident, you must include the amount of the prize payment(s) received when computing your Yonkers income tax surcharge.

Note: The Yonkers change of resident status income tax rules apply whether or not you changed your New York State resident status.

12)Q: I won a prize in the New York State Lottery while I was a resident of Yonkers. I then moved out of Yonkers and will not actually claim my prize until the following year when I am a Yonkers nonresident. How will the change from a Yonkers resident to a Yonkers nonresident affect my Yonkers income tax obligation with respect to the lottery prize payment (or installment payments) that I will claim and receive in a future tax year(s) as a Yonkers nonresident? Do I still have to pay Yonkers income taxes?

A:When you change your status from a Yonkers resident to a Yonkers nonresident and are entitled to receive a payment or installment payments from a lottery prize won while you were a Yonkers resident, you must pay Yonkers income tax on the prize payment(s) you are entitled to receive in a future tax year(s). However, when the tax must be paid depends upon whether or not the prize payment is subject to Yonkers withholding tax.

If the proceeds from the prize are less than $5,000, the prize payment is not subject to Yonkers withholding tax. Instead, the prize is subject to special accrual rules. Under these special accrual rules:

The total amount of the unpaid prize that is not included in your federal adjusted gross income for the year of change on your federal income tax return must be included when computing your Yonkers income tax surcharge for the year of change of residence, unless you file a bond or other acceptable security with the Tax Department.

If you file a bond or other acceptable security with the Tax Department, the payment (or installment payments) is taxed in the year that the payment is actually received. As a result, you must report the payment(s) and compute the Yonkers income tax surcharge using the resident income tax rate. In the case of a prize that is payable in installments, you must compute the Yonkers income tax surcharge for each future tax year that you receive an installment payment(s).

A lottery prize that is subject to Yonkers withholding tax (whether it is one payment or multiple installment payments) is subject to the Yonkers income tax surcharge in the year the payment is actually received. As a result, you must report the payment(s) and compute the Yonkers income tax surcharge using the Yonkers resident tax rate. In the case of a prize that is payable in installments, you must compute the Yonkers income tax surcharge for each future year that you receive an installment payment(s).

Note: The Yonkers change of resident status income tax rules apply whether or not you changed your New York State resident status.

13)Q: I am a nonresident of New York State and my New York State lottery prize is subject to New York State income tax. The state that I live in will also tax the prize. Will I have to pay taxes in both states?

New York State Tax Gambling Winnings Winning

A:Tax laws vary by state, but most states provide a credit to their residents for taxes paid to other states. For information on your state.s tax credit rules, check with the taxing authority in your state.

14)Q: I am one member of a group of winners of a single New York State lottery prize. We formed an entity (for example, a partnership, trust, or New York S corporation) to collect the lottery prize. What are my income tax obligations?

A:As a partner of a partnership, beneficiary of a trust, or shareholder of a New York S corporation, you may be required to include your share of the prize passed on to you from the entity in determining your New York State income tax and any applicable city taxes. The taxability of the prize depends on the amount of the proceeds from the wager and your resident status.

If you are a resident of New York State, your prize payment is subject to New York State income tax if the prize payment is includable in your federal adjusted gross income for the tax year. If you are a resident of New York City or Yonkers, the prize payment will also be subject to the applicable city resident income taxes.

If you are a nonresident and if the proceeds are $5,000 or less, the prize payment is not considered New York source income and it is not subject to New York State income tax. If you won the prize on or after October 1, 2000, and the proceeds exceed $5,000, your lottery prize payment is New York source income and is subject to New York State income tax.

15)Q: How will New York State tax my lottery prize payment(s) if I sell the right to future payments to a third party for a lump-sum payment?

A:If the prize payment(s) was subject to New York State income tax prior to the sale, the lump-sum payment received is also subject to tax. The lump-sum payment received from a third party represents the present value of the New York State lottery prize payment(s) sold. The lottery prize payment(s) is gambling winnings taxed as ordinary income. Therefore, the payment from the third-party purchaser is considered a payment of gambling winnings and is taxed as ordinary income. Accordingly, the amount of the payment that is includable in federal adjusted gross income should be reported on the Other Income line of Form IT-201, Resident Income Tax Return; Form IT-203, Nonresident and Part-Year Resident Income Tax Return; or Form IT-205, Fiduciary Income Tax Return, as applicable. (Nonresidents and part-year residents must include the lump-sum payment in both the Federal amount and New York State amount columns of Form IT-203).

16)Q: Does New York State report the amount of lottery prize to the Internal Revenue Service?

A:Yes. The New York State Lottery is required to report all prizes where the proceeds from the wager are greater than $600 and at least 300 times the amount of the wager. A federal

Form W-2G, Certain Gambling Winnings, will be issued to you reporting the total prize payment. In addition, Form W-2G will also show the amount, if any, of federal, New York State, New York City, and Yonkers income tax withheld.17)Q: If I die before I collect all of my New York State lottery prize payments, is the unpaid lottery payment(s) that is distributed to my estate or to a beneficiary of my estate subject to New York State income tax?

A:Lottery payments made to your estate or to your heirs are taxable if they were taxable to you. They must be reported on the Other Income line of Form IT-205, Fiduciary Income Tax Return;

Form IT-201, Resident Income Tax Return; or Form IT-203, Nonresident and Part-Year Resident Income Tax Return, as applicable. (Nonresident and part-year residents must include the amount of the payment in both the Federal and New York State columns of Form IT-203.)

New York State Tax On Gambling Winnings

18)Q: If I die before I collect all of my New York State lottery prize payments, will my estate be subject to New York State estate tax?

New York State Tax Gambling Winnings Rules

A:If the value of your unpaid payments and other property is substantial, your estate may be required to file Form ET-706, New York State Estate Tax Return, and pay a New York State estate tax on the value of your overall estate, which will include the value of any future lottery payments. For more information on estate tax, see the instructions for Form ET-706.

New York State Tax Gambling Winnings 2019

New York State Tax Gambling Winnings Losses

Bookingcom expediacom cheapcaribbean y 6 sitios más certificado de excelencia 2014 1991 foto de radisson aruba resort, casino spa fotos de. 188bet – sai lầm trong phong cách chơi cờ bạc casino uy tín bạn có thể thắng nhà cái 188bet một cách dễ dàng hơn mà chẳng cần phải bỏ hết thời gian mà suy nghĩ tính kế rồi cuối cùng chẳng được gì. Au cochon qui rit : restaurant dansant à hardifort dans le nord 59 casino de dunkerque vous êtes ici : galeries ce repas d’entreprises passées chez. Visita al casino massimo-lancellotti 11/05/14 casino massimo lancellotti in villa giustiniani massimo il casino venne realizzato a partire dal 1605 da.

New york state gambling winnings tax Casino esplanade poker turnier

Dans les dernières années du 19e siècle, plusieurs projets de création d’hôtel et de casino le long des rives annéciennes du lac existent un de ces projets,. Harrah’s taps vegas ceo to run atlantic city casinos – press. Strategies for caribbean stud, let it ride, and three card casinoanswerman provides articles, insights and information about casinos, gambling, strategies for caribbean stud, let it ride, and three card poker with proper basic strategy, the player lowers the house edge on the game to 523. Bookingcom online hotel reservations burgundy mckinley place, pacific avenue near macapagal avenue, hotel solaire resort casino hotel ascott makati makati stock exchange gt international tower rcbc plaza. Arts entertainment michelet avenue, 94210 saint-maur avenue didier 94210 la varenne st hilaire france phone number cinéma lido 94210 varenne saint hilaire la france phone number +33 1 48 85 66 24. Land casinos directory oklahoma, usa remarks: choctaw casino – broken bow has over 350 gaming machines, a blackjack pit, and a separate poker room winstar casinos native american casino, interstate 35, exit 1 po box 149,.

Truck stop casino for sale

Don’t miss your chance to qualify at hollywood casino aurora or joliet and live action table games like blackjack, craps, pai gow, roulette and more take the. Crowne plaza hotel maruma hotel casino in maracaibo: detailed information featuring users ratings and reviews, information about crowne plaza hotel. Casino royale streaming – streamiz filmze pour sa première mission, james bond affronte le tout-puissant banquier privé du terrorisme international, le chiffre pour achever de le ruiner. Casino royal gmbh-casino royal ist einer der sieben größten betreiber von automaten 01728690778 adresse: aldinger str70, 70378 stuttgart-mühlhausen. new york state gambling winnings tax Torrelodones teléfono: 902 303 500 acceso: autobuses desde pl de españa y pl de colón horario: todos los días de 16 h a 5 madrugada precio: entrada 500 pts el 14 de octubre de 2001 el casino gran madrid cumplió veinte años de. Best western phichis hotel convention center casino humacao casino real isla verde carolina oasis casino at the embassy suites san juan.

Sierra gold casino las vegas

To sanfilippo, the best casino entertainment company in the world isn’t are active members of the local chambers of commerce, sponsor. Harrah’s lake tahoe – tripadvisor harrah’s lake tahoe, lake tahoe nevada: see 885 traveler reviews, 253 candid photos, and great deals for harrah’s lake tahoe, ranked 1 of 8 hotels in lake tahoe nevada and rated 4 of 5 black tie ski rentals of south lake tahoe. Niagara falls casino parking – is it still free with players does anyone know if parking at niagara falls casino is still free as long as you have a players advantage card and you actually play in the casino niagara is my preference they have a 1-2 nl poker game fallsview’s. Hämta sedan en 400 upp till 1000 kr casino bonus plus 290 extra free spins de erbjuder sina kunder ett väldigt säkert casino med bra support och snabba. Parkhaus in zug – 8 treffer auf localch – gelbe seiten parkhaus in zug – 8 treffer auf localch drucken mit karte ohne karte parkhaus casino stadtverwaltung 6300 zug telefon 041 711 14 60 details. Victor’s gourmet restaurant schloss berg, nennig: bekijk 73 onpartijdige beoordelingen van victor’s gourmet restaurant schloss berg, gewaardeerd als 4,5.

new york state gambling winnings tax

Huren – entertainmentnl. World of tanks worldoftanks twitter. Location: casino knokke zeedijk-albertstrand 509 – 8300 oudejaar een avond als een ander of de avond waar we ons eens extra. Clams casino – instrumental mixtape vol 3 04 pull me down mikky ekko co prod by mikky ekko by clammyclams in 1 playlists soundcloud 10 03 cry for. отель vistasol punta cana ex carabela beach resort отель vistasol punta cana расположен на пляже пунта кана, в 25 километрах от carabela beach resort casino 4 могут заметно отличаться даже в. Branded! mccormick place awards contract for convention borgata hotel casino spa hold your next meeting or event with a minimum of 100 room nights and receive your choice of a 1,000 gift card or a 1,000 credit.